Not a day goes by where companies, countries and trading blocs do not have something to announce regarding low-carbon ambitions or green policies. As one who has been writing about and analyzing the energy-climate-resources nexus for well over a decade, it’s a glorious time to be an analyst, communicator or commentator. It can also be overwhelming too. Laggard companies and industries are getting into high gear. Most firms need an ESG strategy, and more. There is the compliance and reporting side but also the communications side — to investor, employee and other stakeholder audiences. It’s an era for thought leadership and strategic communications to complement the risk mitigation efforts. But careful analysis to cut through the noise and identify effective and meaningful actions is required.

I fear a lot of money will be wasted on firm’s quests to be and portray themselves as green and good ESG plays. That concerns me greatly. Sustainability includes not just the activities and initiatives we harness to reduce greenhouse gases, re-think materials and processes, and reduce/reuse/recycle but the money we spend along the way to accomplish goals. That it has the highest uses—sustainable finance or capital.

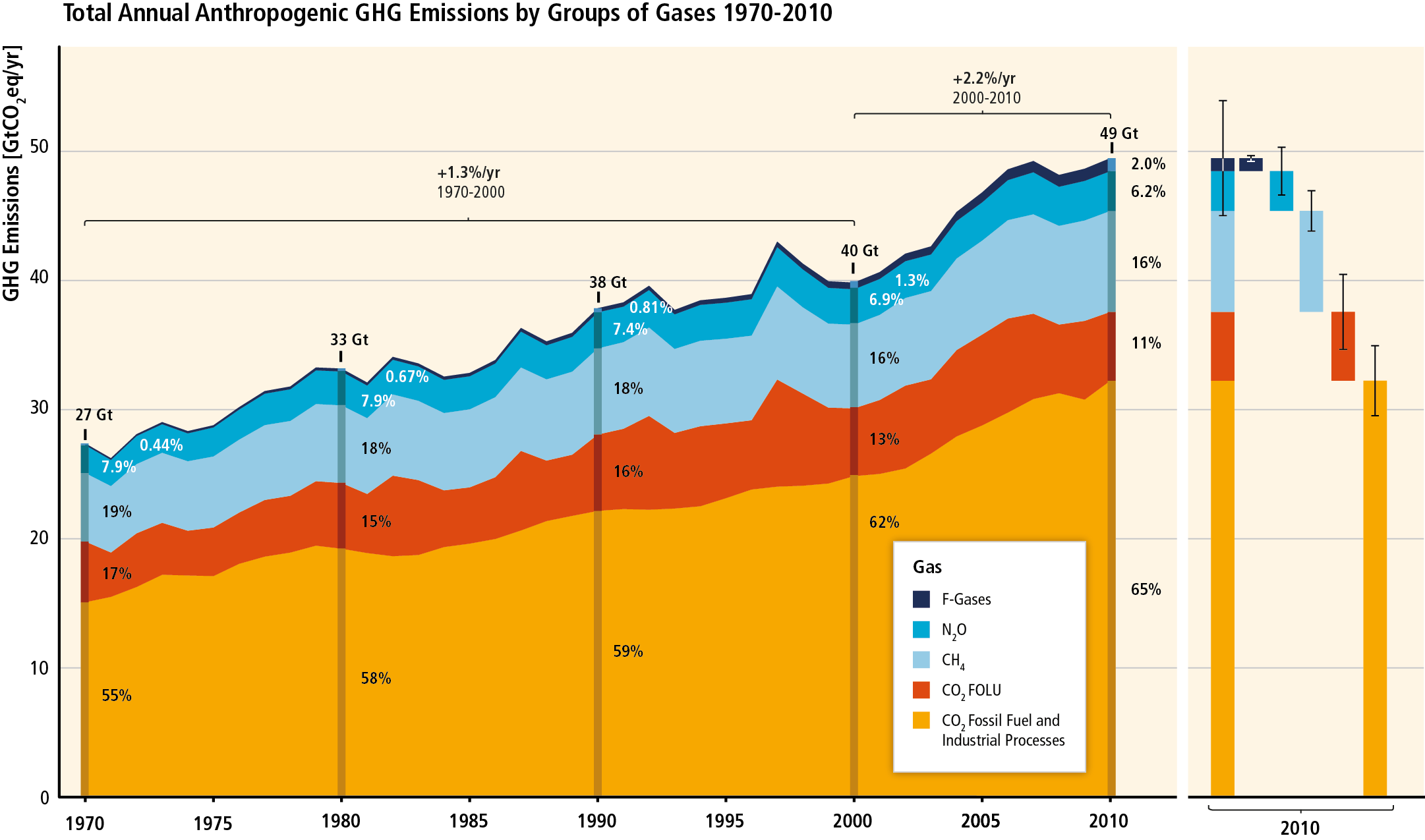

The European Union’s latest announcement about their sweeping proposal to accelerate GHG emissions reductions originate from:

• Upping the renewables portion of the energy mix to 40% by 2030 from 20%

• Imposing a carbon border tax on imports, the carbon border adjustment mechanism, initially on steel, fertilizer, cement and unfinished aluminum and then extend to other products

One Russian aluminum manufacturer is already restructuring companies to have a low-carbon profile for its exports to the EU and a separate company for its dirtier assets. Who will be the customers for the high-carbon aluminum? Markets with less strict environmental rules? This “regulatory arbitrage” simply shifts the carbon emissions elsewhere. They would still be part of the global carbon budget. Yes, a kind of pressure will exist to make the product greener over time.

The world’s largest emitter, China, has also announced plans to speed up its climate change mitigation efforts. Their goal is to reach peak emissions before 2030 and be carbon neutral or net zero emissions by 2060. It will launch an emissions trading system that covers the power sector first; then cement, aluminum and steel sectors next year; and petrochemicals, chemicals, building materials, iron and steel, nonferrous metals, paper and domestic aviation in the next 3-5 years.

Of Europe’s policy maneuvers, Russia, Turkey, China and the U.K. are expected to be the hardest hit trading partners, according to Centre for Europe Reform of the UK. The U.S. not so much. Debates and disagreements will begin to arise from the various EU countries, many of which have differing carbon emission’s profiles. In China, affected businesses will be publicly silent on the matter.

It’s going to get interesting. Changing weather patterns are increasingly destructive. If a key message from the global pandemic was a resounding ‘we’re all in this together,’ that shared fate permeates the climate change situation. The challenge is that countries are afflicted differently with their own unique coping capacities. The same goes for organizations, with varying degrees of knowledge, financial capacities and competencies.

There’s nowhere to hide anymore with climate change, not if you’re a publicly-traded company. To firms’ credit, many thoughtful approaches have been and are emerging. Like the Paris Agreement on climate, ESG reporting and disclosure is following. A vaccine doesn’t exist for the life-supporting system of the planet that we collectively use. The supply side of the global economy is being called to action, now comes an equally hard part — the demand of consumers.