Discusses ideas and more findings in the space

The events of TexCap and North American Blockchain Summit October 8-10th were nothing short of amazing. Held at SMU Cox and the Bush Institute, respectively, who showed up in Dallas, Texas and the thought leadership that emerged will be digested for days and weeks ahead. Many attendees I spoke with said they attended to gather information, or market intelligence, and to network. NAPE Expo/AAPL were key sponsors as well.

My third year now, this year I was focused on the power and digital infrastructure build out, owing to AI, and general trends in the U.S. and global economy. This work shows up in many places as I build this knowledge base alongside others in the field. At my first year of attending in 2023, two panelists on different panels on the Mining stage that year mentioned a site outside of Austin. No one knew of its owner or the plans connected to it. I knew of its genesis, to a degree, but thought a systematic look was in order. Fortunately, the editor at DCEO thought so too. Ultimately, this became “The Resurrection of an Industrial Ghost Town.”

Last year, the market was fact-finding about energy and digital infrastructure shifts, which this year became a panel “Capacity is the New Commodity.” For the crypto mining community, this point of view is apt and insightful, and much is afoot connected to it.

At the North America Blockchain Summit, several takeaways emerged from the panel “Capacity is the New Commodity.” These ideas dovetail with the key messages of several upcoming works.

1) An exec from Priority Power noted that new sites (data centers and the like) are lucky to even get an answer about getting an innerconnection to the grid in 3-5 years. He counted 189 GW in the ERCOT interconnection queue (as of 10/9).

Generally, sites that are able to energize in next 24 months have more value than say, a 2030 live site.

2) Regardless of a firm’s balance sheet and capital, they are all at the mercy of the interconnection queue.

3) A Riot exec noted that capacity is scarce but deals and opportunities are plentiful.

The panel of Core Scientific, Riot, Iren, and Priority Power were all conservative about making announcements about projects until there is a solid interconnection agreement. While Texas is a very favorable climate for acquiring power faster, other markets are accessible too for future growth based on latency and geographical factors, plus the use case.

Bottomline: Capacity is constrained and nearer term projects are more valuable. Caution is advised on announcements that are not fully baked, ie., have an interconnection agreement (and maybe more).

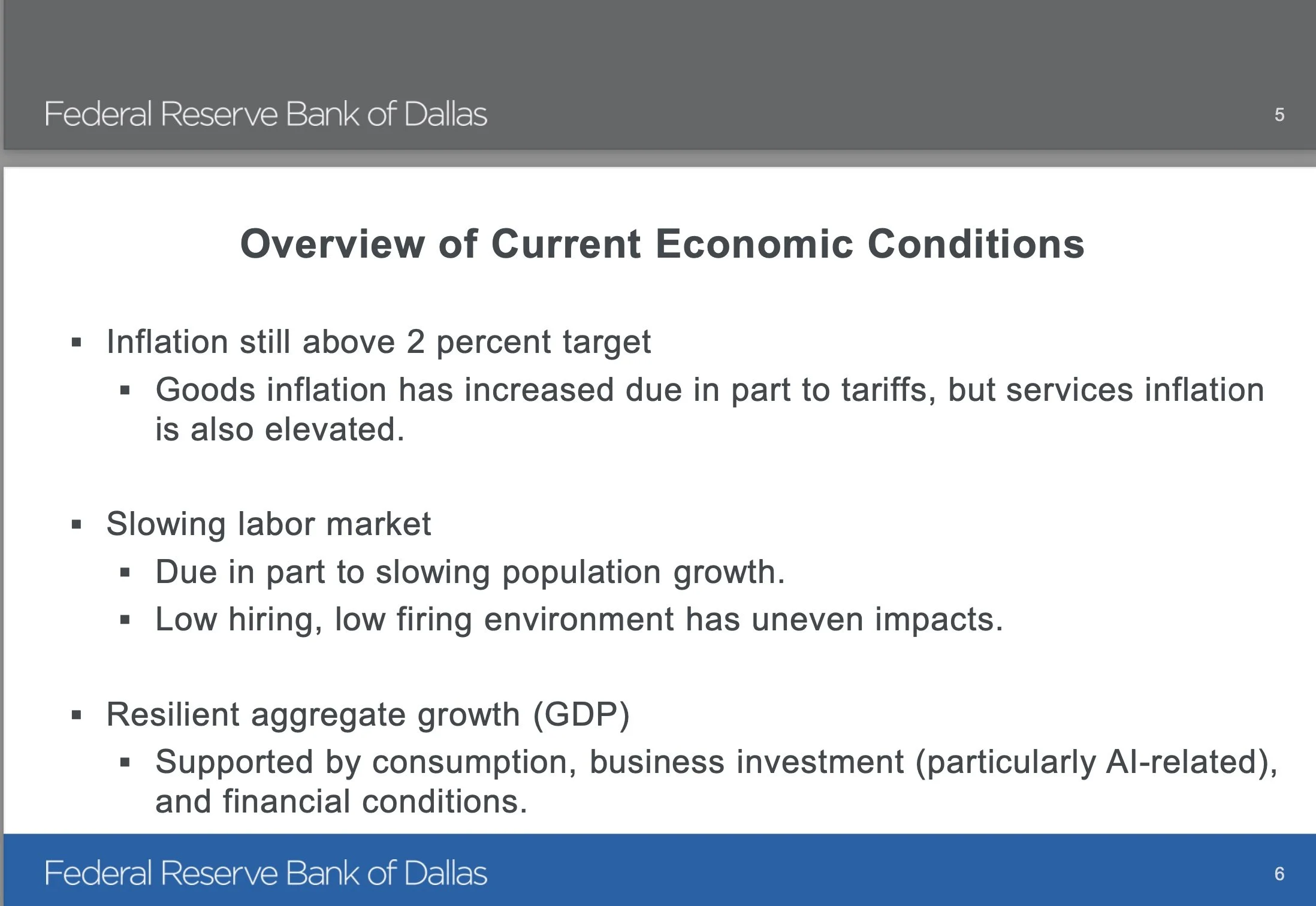

slides in video from the Fed at TexCap and other things afoot

Sign of the Times

While much was Texas-centric, other states are part of the expanding ecosystem. Applied was mentioned on one stage.