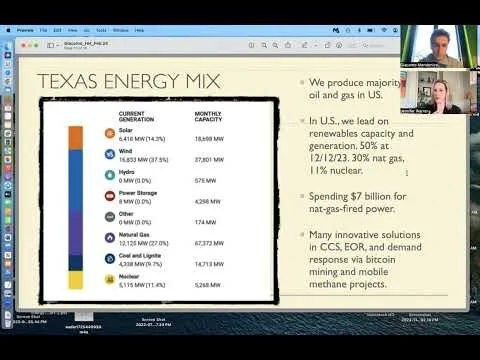

American markets are global markets, inextricably linked to economies for opportunity and prosperity. Our hydrocarbon molecules are infusing other countries’ economies. Lately, the continued mergers and acquisitions in oil and gas have been a dominant theme in markets and analysis. In a recent interview with Italian YouTube channel host Giacomo Mondonico, I discuss the drivers of these many deals, and of which $181 billion has captured my attention. For other’s watching us around the globe, our example of democracy is important.

In looking at the rationale behind the action, several reasons come to mind, not exclusively, but indicatively:

• Capital efficiency;

• Capital market discipline;

• Resource efficiency (which I detail further in an article below);

• Response to demand uncertainties post-pandemic, including decarbonization, and the geopolitics of war.

In my work, however, I view this within the lens of resources and their sustainability. When you change one thing, such as sweeping energy policies, many other factors re-shuffle (to borrow a word from the #FedEnergy23 event).

Importantly, energy security and affordability are key drivers in terms of the economic lives of advanced and developing economies. What is really obvious is that people vote, invest and move to other places accordingly, when they are free to choose. Those decisions are apparent in the out-migration in the U.S. from states two states in particular, and business out-migration from some European countries to the U.S. It’s all in the charts. Additionally, speaking with a Gen Z’er in Europe offers insight into what they are concerned about. They want to know that the U.S. is a reliable and engaged partner.

YouTube Interview “Energy Merger Mania” (2/28) and some short Clips

Clip of Why the Mergers?

I appreciate the projects into which I am invited by clients and other groups and institutions, advancing new approaches, with experience being a great teacher. What comes next —and how we treat natural resources, nature and each other—is a major concern in my activities. I’m mindful of both tangible and intangible assets, something that “the market” really absorbs in this day of technology and innovation. There is a balance. And, market liquidity offers choice. I’ve studied and profiled academic work about liquidity in many contexts.