On May 10th, the World Affairs Council of Montana with KGVO AM 1290/FM 101.5 “Talk Back” broadcast a radio interview with me titled: “Oil and Gas Walkabout: The Rise of U.S. Shale and The Geopolitics Surrounding Oil and Gas.” Across an hour and a half, host Peter Christian and president emeritus Bob Seidenschwartz cover my background that landed me in the energy space, the rise of U.S. shale, geopolitics, the transition and dynamics connected to it, and where my eye is fixed on the horizon ahead. (This link for radio on demand. Scroll to May 10: World Affairs Council.) This body of work spans academia, interviews with 100s of thought leaders, and client and project work. A macro-level focus in energy and resources is paired with the micro-level, often with firsthand experience or capital at stake.

I enjoyed speaking with Missoula and Western Montana! The questions and comments were great, a real window into the thoughts and concerns of the American heartland (and the North).

The energy mix and the transition are a winding road, a journey in which I have participated. The impact of US shale is remarkable and where we are going, hard to envision precisely. But it is part of the energy transition story, of cleaner barrels and more efficient production. U.S. shale is also a key indicator of the price of oil, now a global benchmark.

The energy transition as we know it is diverse, multi-generational and includes many more players than imagined — many with dreams, others with laser-focused practical solutions.

Below is a gallery of reference media specific to the interview and then more backgrounder material follows. Most of my videos have timestamps to topics.

Timestamps of radio interview:

Bio read by host, communications, market making in sustainable portfolios, thought leadership, translating the complex, building long-lived assets (1:50)

Q: Host: What do you do and how did you get here? (2:50)

A: Influenced by tragedies of war, USSR collapse, financial economist and OPEC (5:00), the rise of shale gas and oil in North Texas, kept up the pace

Q: host Geopolitics of energy, resource cooperation and competition. How did you put the pieces together? (6:20)

A: Firsthand accounts and observations: Russia, shale booms, U.S. energy world leader, grounded in financial economist lens, Ukraine invasion (9:45)

Q: Caller: Are you a socialist, coming from LSE? (11:29)

A: From a business family, travelled around the world, anomaly and help of a German friend

Q: Same caller: Economic leanings and ESG thoughts? 13:30

A: I’ve sat on panels and explained my pragmatic middle path (15:50) pro-people, pro-planet. Speed of transition likely slower; Russia changed dynamics (15:50 – 16:15)

Q: Caller: Carbon a problem or resource? (17:45)

A: Nascent on CCS, early days (19:00)

Q: Caller: Carbon issues, global warming (20:00)

A: Challenging to sort. Looking at capital flows, economics, science (21:50)

Q: Host: Policy regarding innovation and creativity (24:50)

A: Shale booms history, 6% of global supply (25:30)

Q: Host: Regulation help or hurt? (29:00)

A: Export ban removed, pipelines, renewables, IRA (29:40)

Q: Caller: Energy independence, geopolitics, nuclear energy (33:00)

A: We are part of a global market; our exports are liked. (34:00)

• We’re an energy powerhouse, an influencer. (34:45) U.S. leadership is needed. 3 bills to bring supply chains back. • Minerals lacking to electrify everything. Density. Developing country demand • Part of planet with finite resources, thus need to use better, share — not an island. (37:00) Energy transition

Q: Host: On creativity and innovation? (37:50)

A: Idea of the market (38:28)

Q: Caller: hydrocarbons and tectonics (40:50)

A: My place on the horizon. Market, geology-aware (42:20)

Q: Host: US as influencer? (43:15)

A: Shale redressed dependence. We are an energy influencer, a global player, a part of price discovery in oil markets. (43:40) Our tech and innovation is resonating.

Q: Caller: Criticism of oil and gas, federal lands issues disingenuous? (48:25)

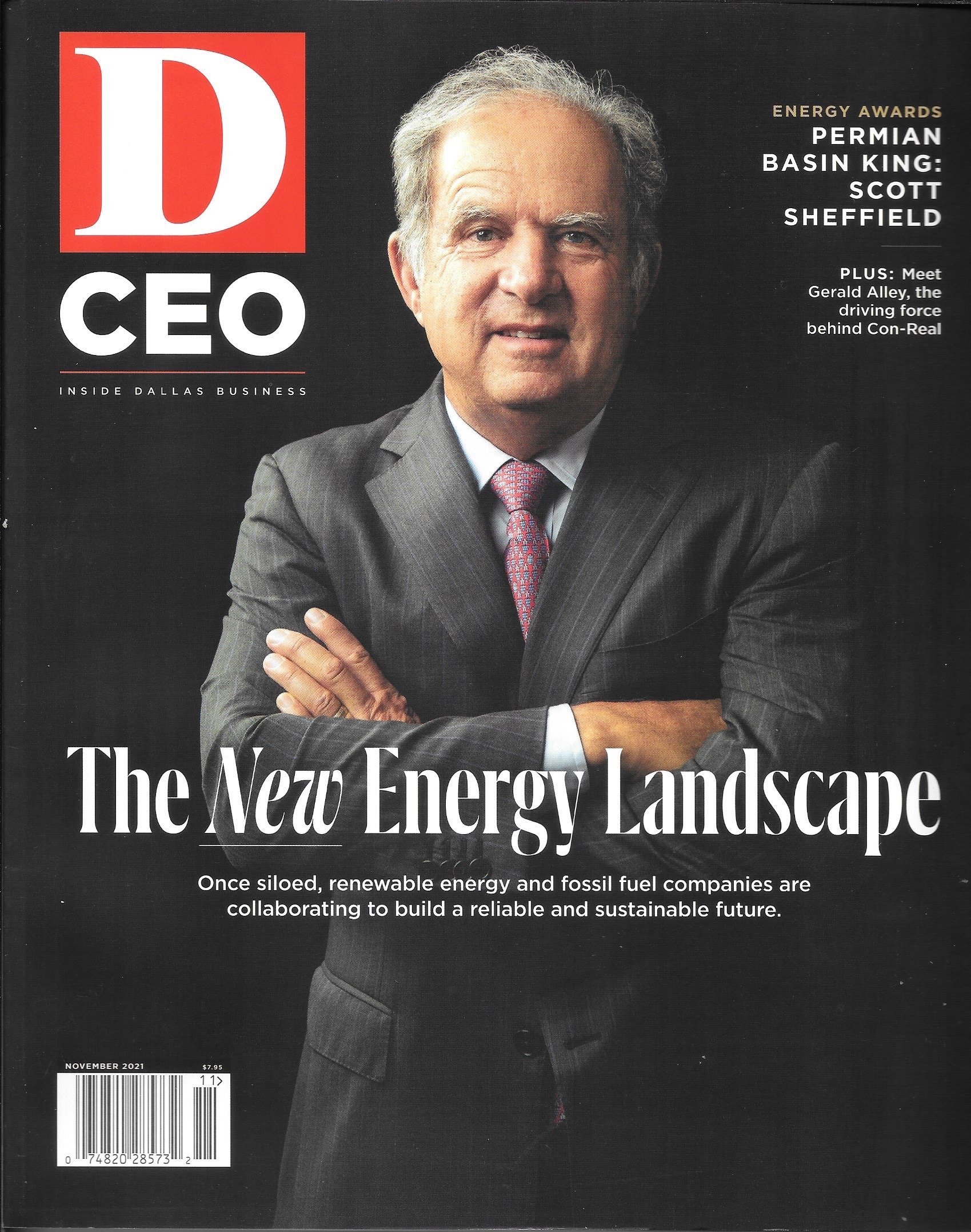

A: Yes. The industry is a jewel and gets a bad rap. See the “Rise of the Permian…” video. (49:00)

Q: host: OPEC, US entry on global stage in oil? (50:20)

A: Industry bashed. There’s a bigger imperative — the global market. Weaponizing energy is short-sighted. Pushing too hard on transition leads to waste, turmoil, setbacks (51:00) Physics (54:00)

Q: Caller: Nuclear, emissions reductions during pandemic (57:00)

A: Net zero, pathways, sustainability hat of resource and capital efficiency (59:00)

Q: Caller: Depletion of shale wells? 1:01:00

A: They can last 20, 30, 40 years, more enhanced oil recovery, innovation marches on (1:02:00)

Q: Caller: Blood diamonds, human costs of green revolution (1:04:45)

A: Concerns me deeply—humanitarian at my core. It’s also the “S” of ESG, the social side. Human capital costs. It’s people and planet. (1:06:00)

Q: host: Capital discipline of industry and higher energy prices? (1:08:00)

A: The price of oil and fundamentals. IRA effect. The market decides. Not cheap. (1:09:00) Be more efficient. (1:11:00)