Note: OPEC just trumped my benchmark musings with its announcement to cut supply. Saudi Arabia plans to cut 500,000 b/d , along with the UAE, Kuwait and Russia which shaves a sum of a million-plus— and then roughly 1.6 million after July. WTI futures had been rising again in the latter part of last week as the banking crisis bhava (mood) started to calm. I think OPEC’s pre-emptive cut announcement could possibly overshoot economic reality unless they believe China’s demand is not quite materializing. Hard to say.

Returning to the longer horizon benchmarking thoughts…

In recent news, West Texas Intermediate, or WTI, a key U.S. oil price benchmark, is now to be folded into the global benchmark Brent, alongside its other constituents.

After years of wrangling, the world’s most important oil price is about to be transformed for good, allowing crude supplies from west Texas to help determine the price of millions of barrels a day of petroleum transactions.

The shift is because the existing benchmark, Dated Brent, is slowly running out of tradable oil for it to remain reliable. As such, its publisher S&P Global Commodity Insights — better known by traders as Platts — has been forced to make a dramatic overhaul.

…Dated, as it’s commonly known by oil traders, helps to set the price of about two-thirds of the world’s oil and even defines the price of some gas deals.

One could think this is a bit esoteric. But it’s infinitely practical. CEO Scott Sheffield called WTI out in January, saying that the futures curve is not predictive of oil prices. I noticed that on price discovery, but now this…

[F]ive existing grades that set Dated — Brent, Forties, Oseberg, Ekofisk or Troll.

If Platts judges that WTI Midland is the most competitive price on offer — or actually sold — then it could set Dated.

So WTI Midland might then influence the price a seller of an Atlantic Basin barrel charges a refinery in China.

Why is this important?

This addition to the global benchmark means that U.S. Permian shale is a significant influence in global markets. The price of WTI, often discounted, to Brent, will morph. What happens in the Permian is thus increasingly important. The physical oil of “Brent” is North Seas U.K. Their production has reduced considerably over the decade. To me, it’s a remarkable development, with U.S. shale oil growing from roughly 2 million barrels per day in 2010 to 12 million by 2019.

In chronicling the U.S. shale oil boom (gas in its early take-off), and figuring out its impact on global prices and production, I noted that U.S. shale was moderating global prices for a period. Oil prices are inherently volatile owing to geopolitics. There’s a large body of academic work that supports this contention, as well as my “practitioner” work from October 15, 2013 through today. However, U.S. shale, its persistence—in spite of the many analysts commentary about its poor investment characteristics and the haters—has endured and become a global benchmark. (Graphic below.)

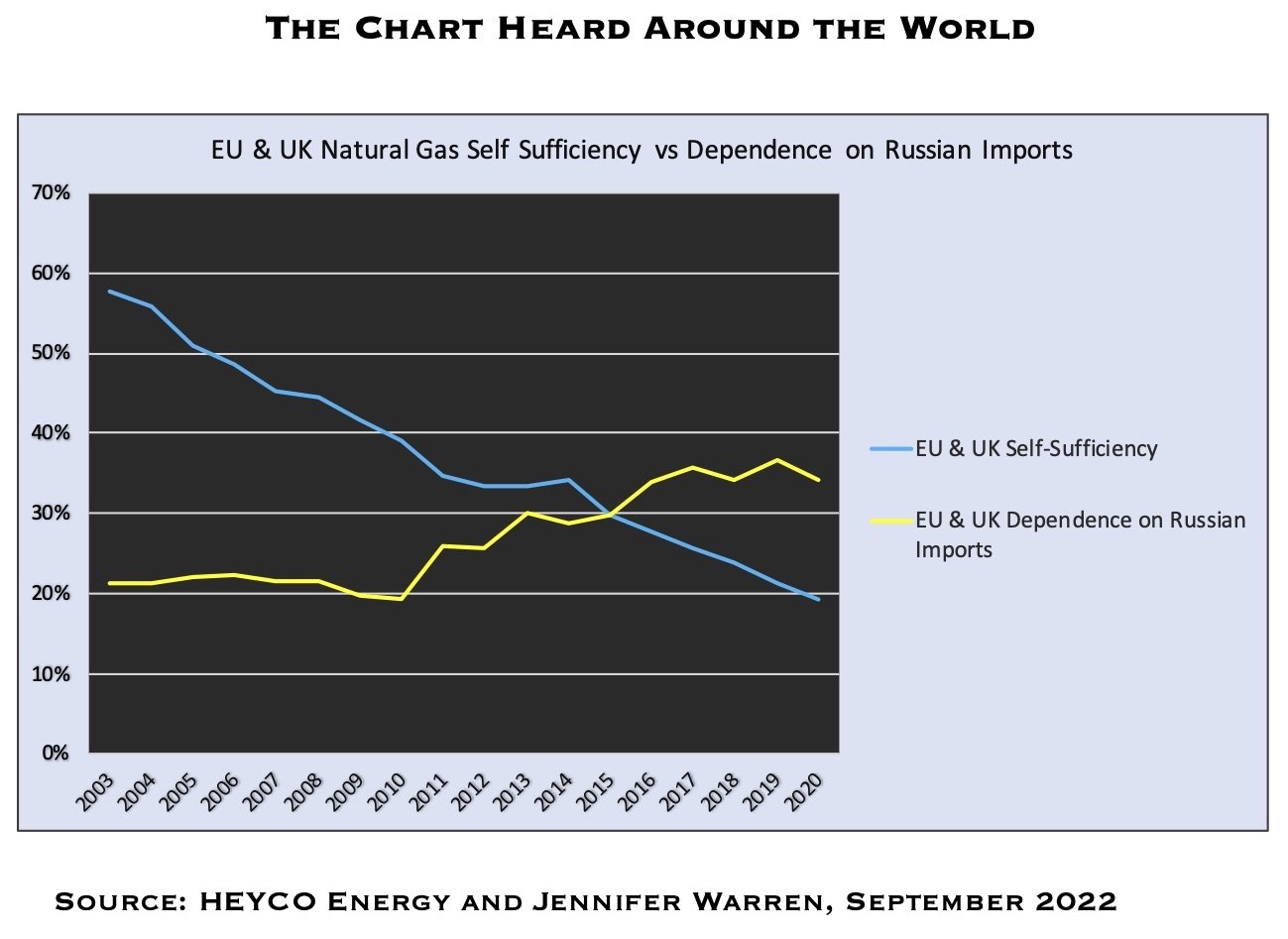

Putin’s disinformation campaign about keeping U.S. shale out of Europe worked for a long time. This is all documented. Until it hasn’t. (See “Chart Heard Around the World” and “Solving Europe…” video below.) We know what Russia’s Ukraine war has unleashed.

At CERA Week, an admittance by a world energy leader about U.S. shale, was telling. In the past, U.S. oil was a price taker, now it’s a pseudo-price maker. As noted in many articles past, entrepreneurial grit, innovation and perseverance are at the heart of this development. If interested, the run up to the Permian shale boom is documented here.

Influencing cleaner barrels

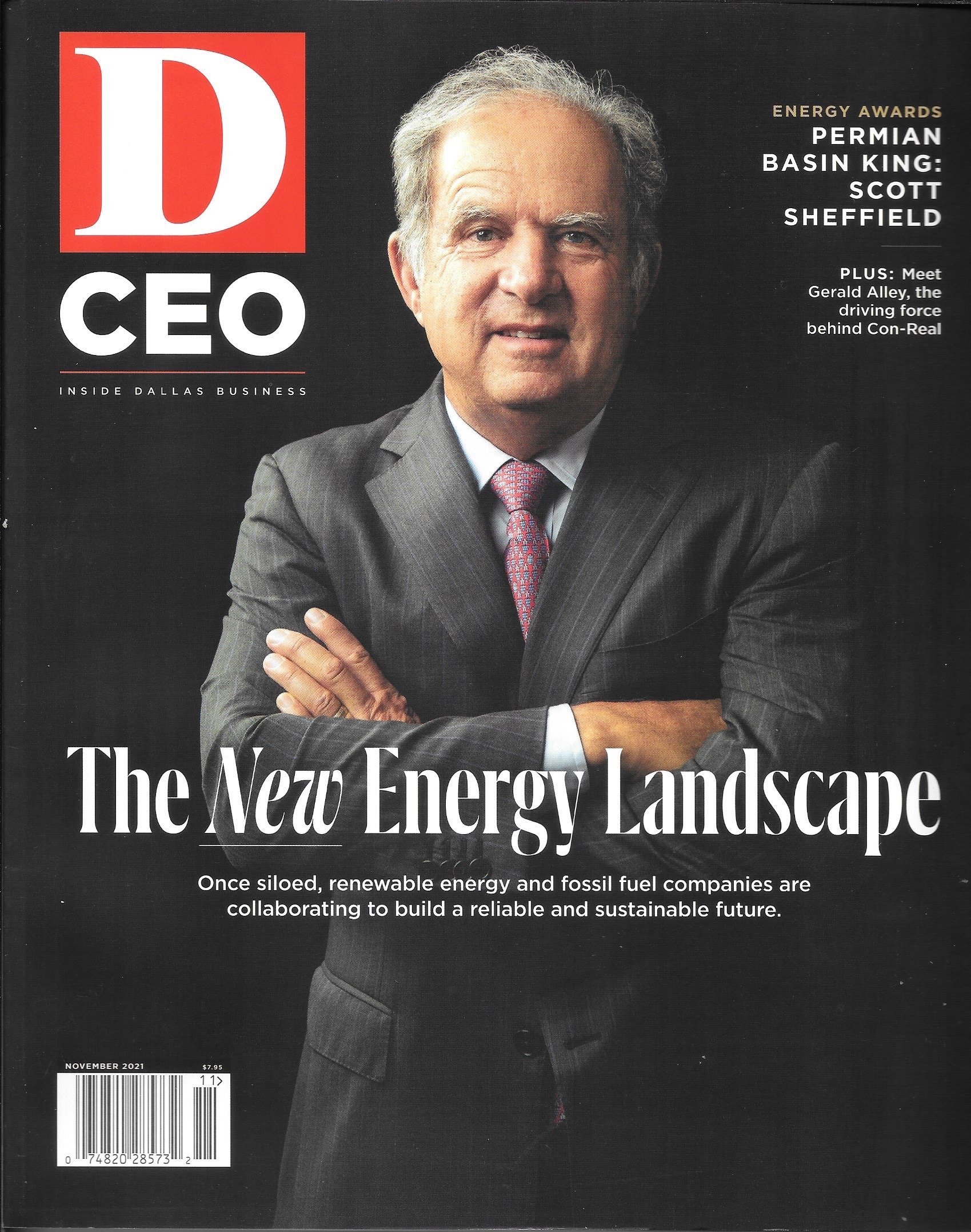

In my November 2021 D CEO energy edition article, the implications of net zero and its impact on cleaner barrels was discussed. This was just eight years after the 2014 break out article about the Permian oil boom, with work commencing on it six months earlier. With the attention to decarbonization and other GHG emissions—owing to the science of global warming, the ESG catalyst and sustainability sentiment—top U.S. producers and the global majors are all focused on their emissions profiles.

With the Inflation Reduction Act (IRA) legislation, great attention is directed toward carbon capture and storage (CCS) as it pairs most easily with oil and gas production. Just recently, the UK has shifted its green ambitions toward a CCS track. I would say Canada too (though they like the minerals value chain as well). This is inflationary, adding additional cost to the production of oil and gas. The credits and subsidies of the IRA are a policy tool to shoulder some of the costs of greening production. While given a 10-year runway in the legislation, clawbacks could occur owing to budget pressures elsewhere in the next years. EVs eligible for the credits have been reduced with local content and supply chain tweaks. Eventually, the taxpayer will decide through elections when the implications are more apparent — pensions, health care, and/or cleaner energy. However, these are generational shifts in priorities and investment in the future is paramount while paying for social entitlements.

Additionally, and potentially, as a producer of over 10% of the oil market, the U.S. with its newly-minted Brent inclusion, is an influencer in the future of sustainable barrels. But a great deal of work is to be done. What happens in Texas, isn’t staying in Texas.

Energy Transition Happenings

Houston likes to claim title to being the energy capital of Texas and the U.S., and at times, the world stage. Given CERA Week in March and events of this past month, it is a valid assumption. But if Houston is the seat of U.S. oil and gas, Dallas just may be the pulse—the heart beat— of the transition. The Dallas scene of the energy transition includes a mosaic of players and influences. There is even shuttle diplomacy between the two centers of thought leadership. Texas’ economy has been a source of economic study, as a proxy for both the energy transition and its ability to dodge recession or not.

I leave the rest of this commentary to another day. I was recently impressed with some young entrepreneurs cutting new paths in the energy space; they presented their business models at the Maguire Energy Institute last week. Below are some visuals that describe the many colors of the transition and those connected to it. I’ve had the great fortune to be part of the storytelling.