Everything pales right now compared to the ripple effects of this banking crisis. But certainly not the week of March 6th at CERA in Houston, the global energy event, where I was. The last two days have been spent at an investor conference during Austin’s SXSW event tech days. Dory Wiley, CEO of Commerce Street Holdings, a seasoned banking investment veteran, offered color about day one of the market’s opening after Silicon Valley Bank’s (SVB) collapsing episode. I thought about the movie “It’s a Wonderful Life.” We were having a modern-era bank run, fueled by the rumor mill of social media and commentators. But the Fed had also stepped in and done their job.

Noted in the talk were three circles of contagion—venture capital, crypto and a bond bubble. At the heart of the SVB crisis was a mismatch of assets and liabilities. Concentration risk also played into the mix. From both this talk and the conference’s investor attendees, banks were noted to be tightening credit as interest rates have risen. The effects of this were being revealed in real estate loans as noted in a Dallas Fed Texas economy outlook 2023. (See video “Global Energy: Inflation, Dislocation…” and below.) We may be a best case scenario in tough times.

The commercial real estate sector is thought to be the next casualty of the fallout in the economy at large, with its interplay with interest rates and secular trends of remote work. In terms of more recession-proof economies, Texas has characteristics that uniquely buffer it, but not forever with growth potentially slowing.

The manager selection and alternative strategies panels overlapped, with SVB a cautionary tale. Some of the investors that were not tech investors—the value investors—were excited about the mispricing of assets currently. This rotation from tech, which began last year into “old industry,” was noted in several videos, and particularly the advent of the end of cheap money discussed with Accounting Professor Sean Wang, and other investor calls. It is as if we have been watching a slow-moving train wreck for a year. Now, think managed futures, for portfolio guardrails, an investor opined, and picks and shovels, both public and private markets. One speaker was also advocating non-correlated assets such as private credit and litigation funding, but not private equity.

Moats were liked by the Amera Securities representation, and an attendee remarked later that the moats idea was not commonly used by private capital guys. (It’s bandied about in public investing circles, and a highly useful strategy.) Also of interest by an investment firm were green bonds, 5-7 year-return offerings inherent in private credit, and renewables with off takers built-in such as utilities. A venture debt fund manager, whose phone was ringing off the hook, liked real estate, infrastructure and noted the demand for capital by those who know how to deploy it.

It’s a due diligence world. That means information, trustworthiness, and credibility. Track records matter.

The oil and gas panel was seated with real pros, leading private enterprises. I have more extensive notes for another time. One takeaway: the issues of scale and repeatability are important in producing resources, whether a private or public firm. Natural gas and LNG are vital energy sources and growing in demand, globally. They corroborated this trend noted since the invasion of Ukraine by Russia.

At the end of day one panels, portfolio diversification in real estate was addressed. One major investor spoke about renovation and repurposing of real estate assets, alongside their forays into opportunities in the tech stack. Both multi-family and industrial real estate were favored by this investor, and given the credit crisis looming for smaller ventures. I thought it is really a buyer’s market, those with dry powder, now, versus sellers of tech opportunities. The tables have really turned.

Surrounded by New York investors and Austin tech and investment innovators, my presentation to come on day 2 felt like a “Lord of the Rings of Energy” presentation. It follows, with some notables post-CERA, then my brief panel presentation from among four other panelists. I will highlight my findings from the panel in a few days, alongside the oil and gas-specific thoughts as above-mentioned. The panel discussion on ESG-energy was engaging. (Video to be available in a week or two.)

It is a volatile and dynamic time, with the themes of disclocation, opportunity and sustainable approaches at the forefront. The fundamentals very much apply though. And energy is fundamental.

Post-CERA Introduction

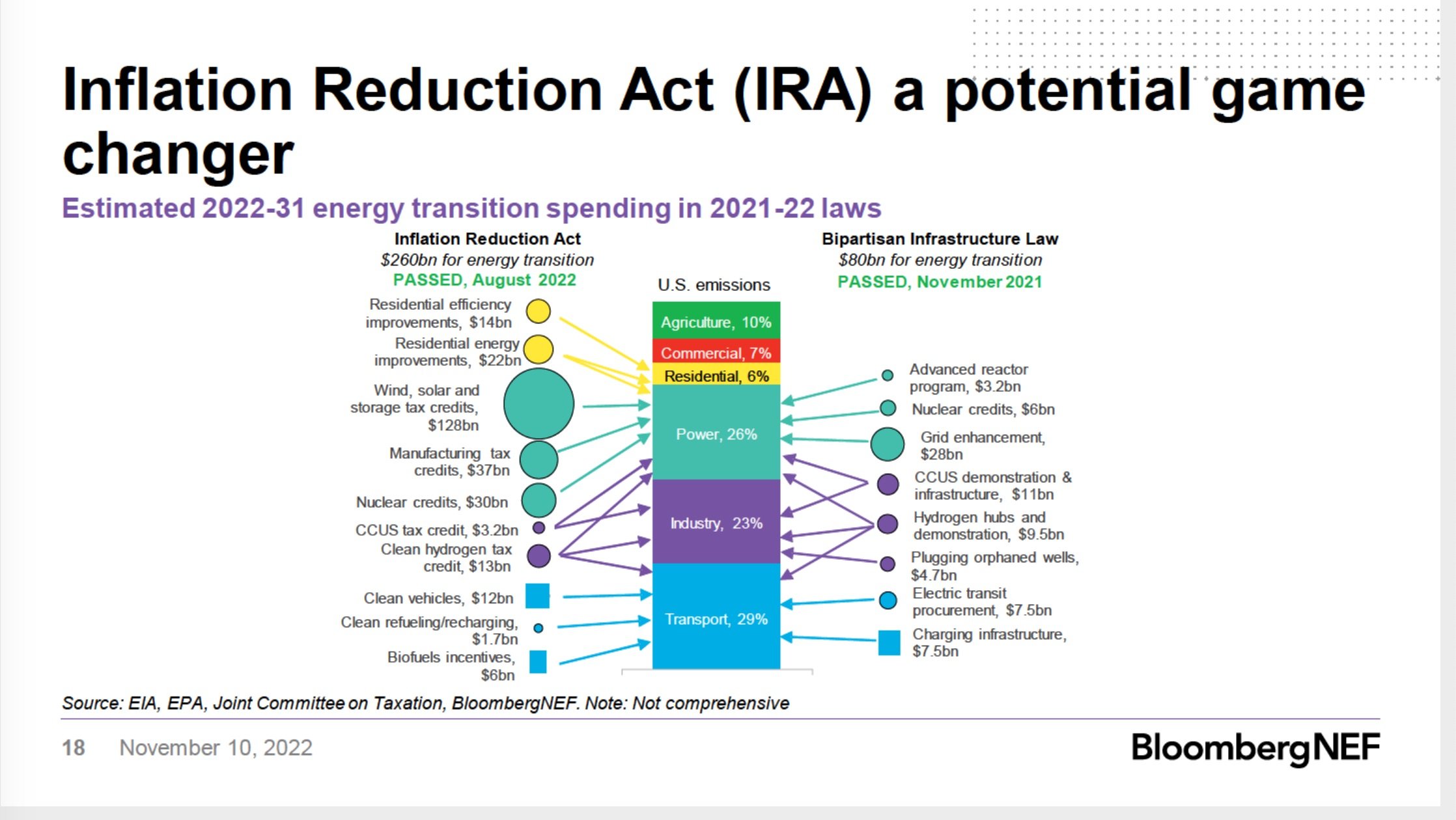

What was heard on an investor call from an oil trader in September 2022, identifying how Russia’s oil was flowing differently, we now have more color. Post-CERA week, where the global energy world just converged, is the occasion for media and other venues to hash through what is happening in oil, gas and the transition. Where traditional and newer energy sources merge and intersect is becoming trickier to disentangle. The U.S. Inflation Reduction Act (IRA) is sparking a kind of renewal in the space for all market participants. Grounding oneself in the oil market is a start. I turn to Russia briefly.

According to S&P Global, much of Russia’s lost European market has made its way to India, China and Turkey. “Russian oil flows to India have been barely a year old, but at around 1.5 million b/d it already makes up more than 30% of Indian crude oil imports.” A shadow fleet was said to have already been in the works before the December embargo went into effect. This oil has displaced Middle East, West African and US crude oil imports. The price discovery impact for Ural oil is an approximate $18 per barrel discount to Brent, the global benchmark. Other geopolitical factors are at play. This becomes relevant in two ways.

First, trade flows are changing in specific ways. This was noted in a S&P article post-CERA of March 10th. OPEC has downplayed its impact, as Russia is part of the OPEC-plus pact, citing that flows are simply re-directed as happens. Second, these 1.5 million barrels per day, a piece of the market volatility puzzle inherent in oil markets, has trickled through, found a home. What is the stickiness of this? What are its implications on price in the short- to medium terms? How does it matter? According the BP analysis I recently parsed, it is a GDP hit for everyone, but more so for developing countries further out in time. (Video “Global Energy 2023: Ripples …” below.)

And OPEC can play the long game, as many forecasts suggest they begin to recover market share after 2030, when the U.S. is thought to plateau. The challenge is crafting the right policy. They misfired in 2015-16. And again during the pandemic as Russia took a stance contrary to OPEC’s position. (I have all of this chronicled.) But, the market is the market. And eventually, the market dictates and overrides favored policies and prescriptions whether by a government, an influential group, or a mega-investor. Time is a factor though…And now to the energy transition.

At CERA and for the last many months, the U.S. IRA legislation has been top of mind with business and governments, particularly in Europe but with the Canadians as well. This was evident at a gathering during CERA. It makes sense to be aligning with like-minded partners. And after all, we form a vitally-important North American energy bloc. Canada produces roughly 5 million barrels of oil per day, or 5% of global supply. The Canadians have been pursuing and incentivizing CCS tech for a few years. U.S. oil production stands around 12 millions b/d. Suffice to say, North American barrels are in ample supply to become cleaner barrels or in gas, cleaner bcfs.

The energy-related ESG panel at IVYFON

Hard assets. Real happenings. Capital case.

1) Macro energy landscape post-CERA.

Market drivers and dynamics:

• Oil. A tight market is expected the second half of 2023. That means higher prices than the recent $70-80 range (exception being now the crisis fallout). The futures curve does not predict oil prices well. We are in a new period in oil demand…It’s cloudy. On the supply side, all producers are pumping to capacity.

U.S. independents were globally recognized by certain global parties, and those parties want to cooperate more with U.S. shale. We pick up Russia’s losses of oil production and LNG exports, for now.

My thoughts: US shale increased 2 million b/d in 2010 to roughly 12 million. Russia declines from 12 million b/d to 7-9 million by 2035, or 5-7 million b/d decline per BP’s outlook. U.S. independents are beneficiaries. U.S. shale gas breaks out c. 2005-6; c. 2013 for shale oil. But…my story of Yates dates his early work in the New Mexico side of the Permian with Sandia Labs in the early ‘80s. George Mitchell then applied it to the Barnett Shale.

• Gas. The main story is a global gas map being re-drawn. The contours were not quite clear in October, but are more clear now. LNG competition for cargoes exists between the EU, China, Japan, etc. Japan is rightly concerned, and desires to elevate the LNG issue of energy security at the upcoming G7 agenda.

The U.S. picks up 50% of Russia’s LNG trade to 2030, largely directed to the EU and China, but other Asia as well. We have export constraints. More LNG terminals need to be developed, and investors need to be discerning about firm capabilities and balance sheets. Pipelines and constraints exist in Appalachia (the Marcellus) and production.

My takeaways: Texas and the Louisiana Gulf Coast are the seat of exports of oil, refined products, and LNG, and will be participating in the “energy transition” through the Inflation Reduction Act, also known as U.S. climate or green policy.

Note: This is where many U.S. players are developing cleaner barrels and new tech is emerging for natural gas emissions reductions too.

Green happenings:

Texas is the leading state in wind and solar, and going forward, and battery storage investment is apparent.

The Gulf Coast is a beneficiary of the IRA through firms of all sizes. Oil Majors are forming partnerships and making announcements in CCS, sustainable fuels and hydrogen.

The IRA is the great leveler of new approaches. Significant funds are available for wind and solar, but green shoots are emerging in CCS and hydrogen.

Some reference slides (updated 3/21) and video on WAR and IRA

Videos with research and data in ascending order (with topics and timestamps by clicking “More” in description).

“solving Europe’s Energy Crisis” offers historical context and the invasion set up.

“Some U.S. public pension and investment funds are pulling back on private equity (after a decade of aggressively pursuing the expensive, risky and hard-to-trade asset class).

Maryland’s $65 billion retirement system; Alaska’s $77 billion state fund; and Mendocino County, Calif., are opting against introducing private equity.

“We think you can get to the same destination with just public market assets and your real estate and infrastructure portfolios,” an investment consultant noted, advising a board. ”