Re-published from Dialogues, United States Association for Energy Economics

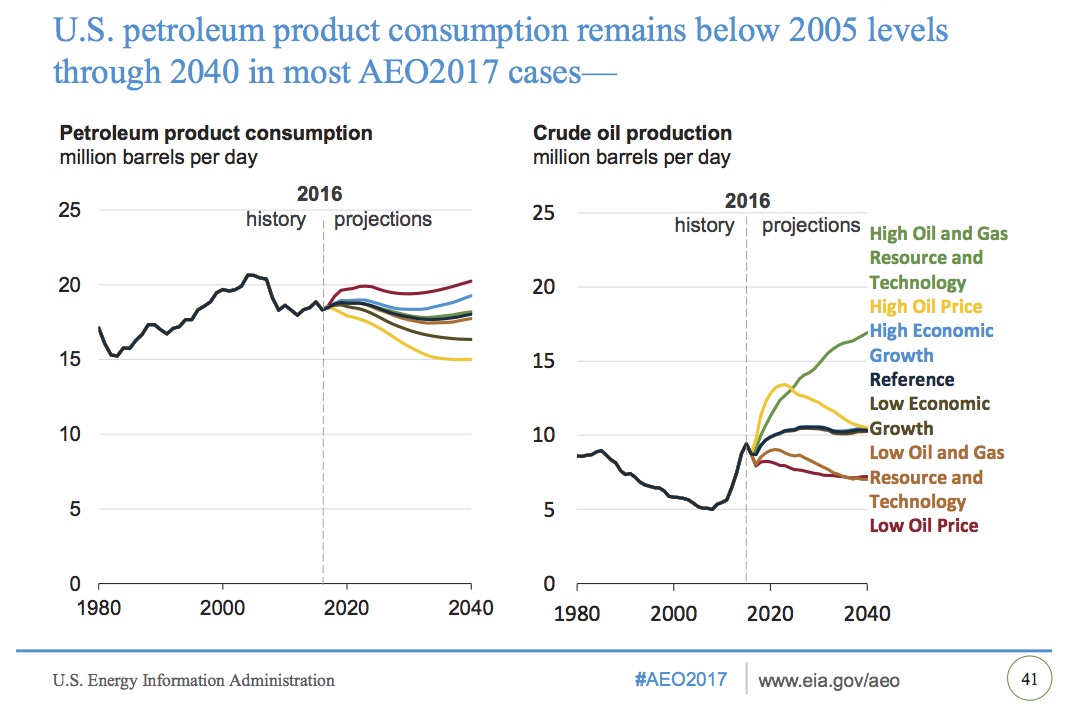

Over the next two decades, natural gas production grows and so does demand in the resource-rich U.S. The price of natural gas is expected to stay in a range of below $4, and climb to $5 for the next couple of decades, according to the Energy Information Administration's (EIA) 2017 outlook. "At the low end of the price range, this forecast reflects the incredible abundance of low-cost shale resources," says Ben Schlesinger, gas expert and professor at the University of Maryland.

Fields aplenty

The prolific Marcellus-Utica fields have greatly extended the resource potential of the United States. In a 2016 presentation, Schlesinger compared the Marcellus-Utica to Russia's Yamal Peninsula, its largest gas resource with annual potential production of 310-350 billion cubic meters (bcm). The Bovanenkovo field, the largest in the Yamal region, has potential production by 2030 of 220 bcm — the Marcellus was already producing 219 bcm in June of 2016, and now 233 bcm. Qatar's production was 181 bcm in 2015, with approximately 25.1 (trillion) tcm of estimated recoverable gas, compared to the Marcellus-Utica of 12.8 tcm. One difference: the Yamal region is in the Arctic in comparison to the Marcellus' near-suburban location of Pittsburg, Pennsylvania, cites Schlesinger, meaning a different and far lower cost structure and access.

Source: Ben Schlesinger Associates, 2016; EIA June 2016; Gazprom; BP 2016

Most Marcellus-Utica gas today is flowing south to meet Gulf Coast demand, west to Chicago, and northward into Central Canada. As Schlesinger points out though, pipeline capacity in the Northeast is still limited, by design, from states' energy choices. In addition to the Marcellus-Utica, more gas discoveries have come to light in the Permian Basin. Apache Corporation recently announced an estimated 75 trillion cubic feet (tcf) of rich gas in the Permian's furthermost corners of the Southern part of the Delaware Basin called the "Alpine High."

Gas movements

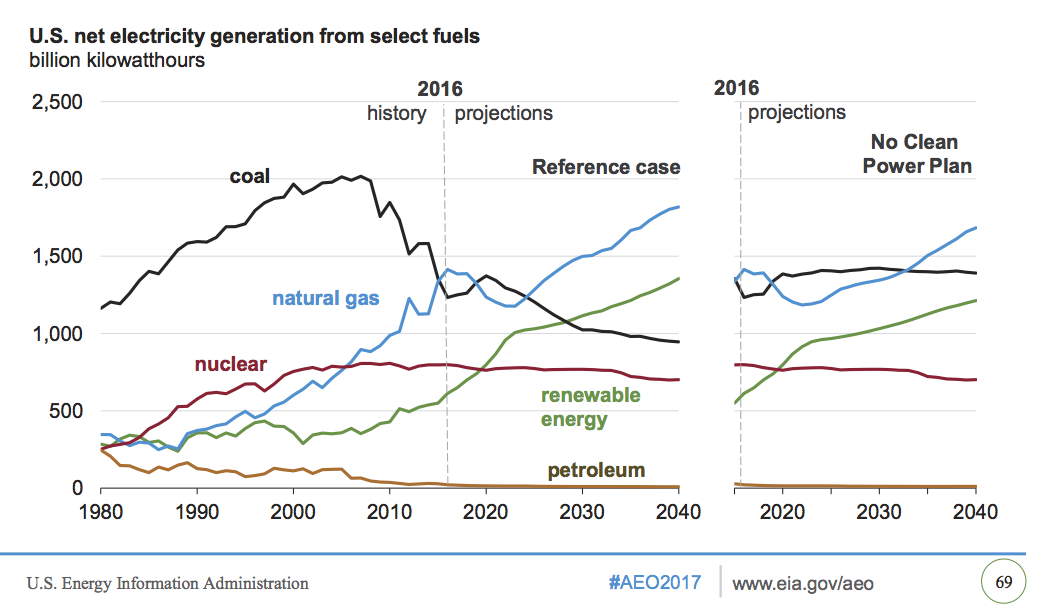

From natural gas demand and production growth, shale gas is expected to be the largest contributor to U.S. production growth to the year 2040. Schlesinger notes, "Demand grows around the Gulf Coast region because of industrial demand, LNG exports, demand from Mexico, and power plants. This gas is moving south. Price depends on how long the Marcellus-Utica holds out, and what new technologies come along."

The natural gas export story for the U.S. has already had twists and turns. According to the EIA 2017 forecasts, after 2020, U.S. exports of liquefied natural gas (LNG) grow at a more modest rate as U.S.-sourced LNG becomes less competitive in global energy markets. "I do not see the 16-20 bcf per day of exports as in earlier forecasts," Schlesinger assesses. "The U.S. regulators have approved enough LNG projects now to make us the largest exporter in the world by far —more than Qatar even. But some of these projects, and others waiting in the wings, are not fully subscribed and are on hold." Schlesinger suggests the U.S. will hit a certain level and then hold at that level, to see whether a second tranche of projects will see the light of day.

In 2016, total exports of U.S. natural gas were nearly 7 bcf per day.[i] Eagerly anticipated, the U.S. also began exporting liquefied natural gas in 2016 from the Cheniere-Sabine Pass facility, with ultimate capacity of over 4 bcf/d. [ii] Four more facilities are under construction. U.S. natural gas pipeline exports increased by 21.7% to 5.9 bcf/d in 2016, largely because of rising exports to Mexico.[iii] Part of Mexico's energy policy included in their five-year plan calls for the increased import of U.S. natural gas as the country grows it share of natural gas power generation. With the recent contentious political atmosphere between Mexico and the U.S., however, energy firms connected to the production and midstream side stand to lose out if trade and cooperation becomes imperiled.

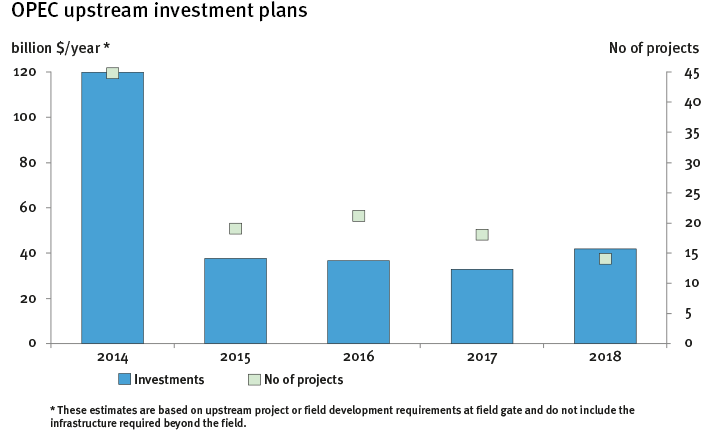

Other regions in the world such as East Africa, China, and Argentina are keen to develop their own resources as well. Depletion, competition from other suppliers and technological advances will potentially keep the lid on LNG prices. "We are not going to flood the world with U.S. LNG," surmises Schlesinger.

Changeable energy

The energy scene is changing. Just as technology revolutionized drilling in the U.S., bringing a revolution to oil and gas producers and related industry, other energy forms are becoming more competitive. "Cost are down in solar energy, with many more installations on the horizon," observes Schlesinger. "This is wreaking havoc among some utilities. Then you couple batteries with solar energy and it will change how people power their homes in regions like the Sunbelt." While renewable energy forms displace coal-fired power generation, they also may curtail a portion of gas-fired generation as well, Schlesinger relayed.

Market pricing and competitive forces alongside technological change will constrain and influence energy production and choices. The market will drive America's energy mix, but new policy directives can potentially provide some tailwinds or opportunities to maximize profit for companies.

Jennifer is a writer and communications specialist focusing on energy, resources and thought leadership work for companies and institutions. Her work has appeared in numerous academic, policy and business publications.

[i] http://www.eia.gov/todayinenergy/detail.php?id=28932

[ii] https://www.eia.gov/naturalgas/weekly/archivenew_ngwu/2017/01_19/

Natural gas pipeline deliveries to the Sabine Pass liquefaction terminal averaged 1.9 Bcf/d for the report week, 14% higher than the week earlier. Pipeline deliveries set a new record on January 18 reaching 2.05 Bcf/d, indicating the start of the commissioning of Train 3.

[iii] http://www.eia.gov/todayinenergy/detail.php?id=28932