An extensive track record of written publications for organizations and bylined work in high-quality venues. A short list below.

D CEO: America’s Shale Revolutions, 2022, 2021, 2019, 2014 and 2008

“The Pipeliner’s Dream” Nov 2023 (link)

“Solving Europe’s Energy Crisis” Nov 2022 (link)

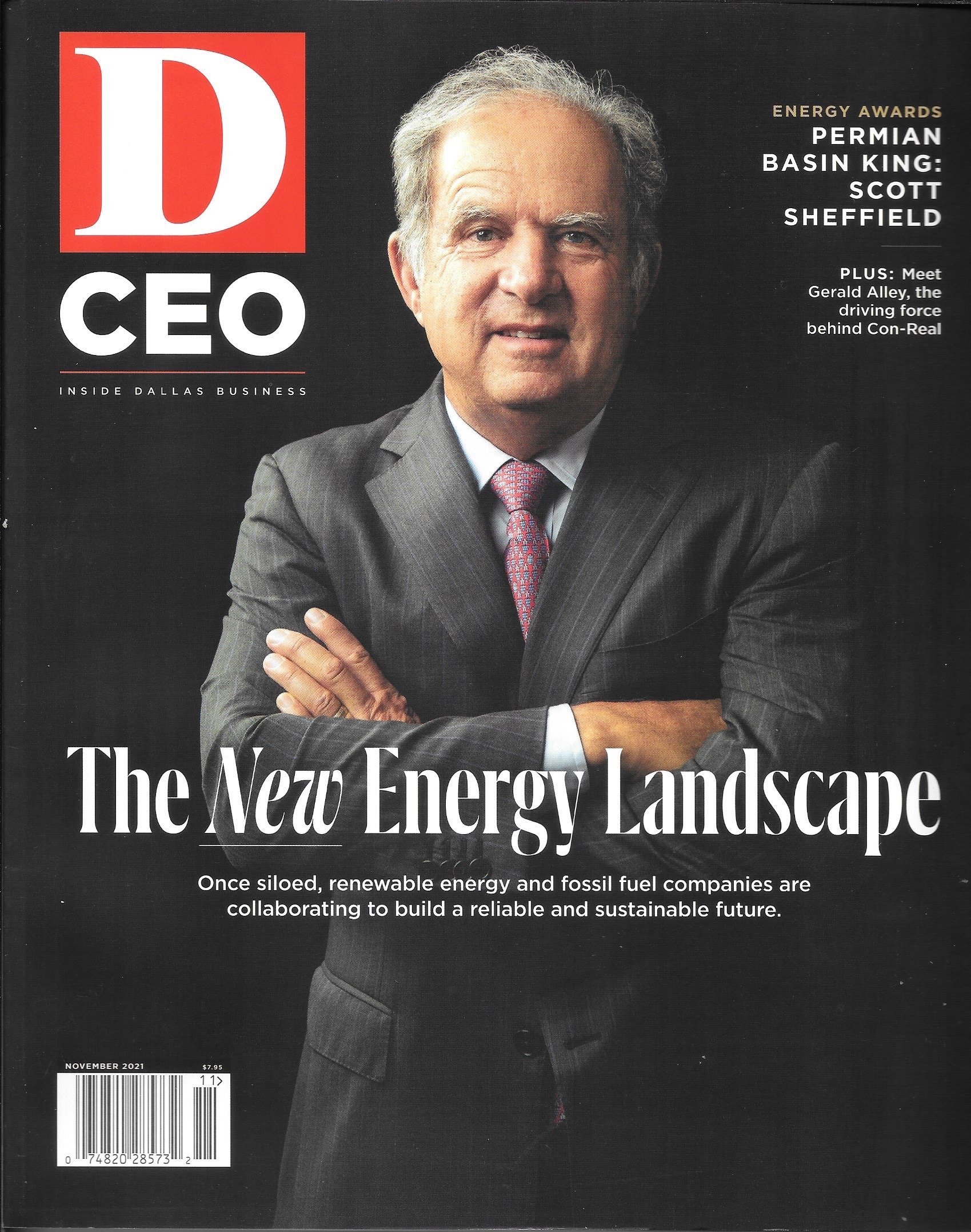

“Scott Sheffield is Leading the Energy Transition” Nov 2021 (link)

“Trevor Rees-Jones Pioneered Plays That Changed America’s Energy Industry” Nov 2019 (link)

“The New American Energy Revolution” Jan 2014 (link)

“Barnett Shale: A Winning Play” 2008 (link)

FEATURE ARTICLE: “Oil's Wild Ride” | D CEO, May 2016

The story of how North Texas oil and gas firms were survived the oil bust, from the perspective of multiple stakeholders. Read More

The Ranch King, October 2022

Gazing out at an expansive new listing in southern Dallas, ranch broker “Bernie” Bernard Uechtritz narrates how the land becomes rolling hills at roughly this very point in Texas, unlike the flatlands in the highly developed region north of the city.

Read the cover story.

FEATURE ARTICLE: “How Fluor Corp. Became a Building Behemoth” | D CEO, May–June 2015

Known for its mega-projects – and for its ability to complete them in the harshest conditions in far-flung places – Fluor Corp., with CEO David Seaton at the helm, displays geographic reach and diversity of operations. Read Article

FEATURE ARTICLE: Interview with Energy Transfer's Kelcy Warren | D CEO, Oct 2014

Interview with Energy Transfer's Kelcy Warren, as his firm adapts to the changing landscape of U.S. energy production. See the Q&A in D CEO's special oil and gas issue.

COVER STORY: “Pioneering the New American Energy Boom” | D CEO, Jan-Feb 2014

With some of the best acreage in the Spraberry/Wolfcamp play, Pioneer Natural Resources, under the helm of CEO Scott Sheffield, is part of the new oil boom. Pioneer was in the right place at the right time—proving the prolific shale oil discoveries within the Permian Basin. See article

BOOK: Chronicles of An Oil Boom: Unlocking the Permian Basin, Jan 2014

After 2009, the collapse of natural gas prices led to the switch by forward-looking exploration and production firms toward oil exploration in order to remain profitable. Some energy firms were pioneers in these efforts. The oily Bakken and Eagle Ford Shales launched into full swing. Then came the analysis of the Permian Basin in West Texas. Now, another shale mega-basin has the potential to change the game again, at a time when the U.S. economy is still mending. Download ebook

OP ED: “North America's Rising Star” | Lloyd's List, Apr 2013

A re-thinking of North American energy resources and its impact on trade routes. A more resource-supplied U.S. offers a different lens through which to view the infamous "Asia pivot" of the Obama Administration.

BOOK CHAPTER: “Targeting the Future: Smarter, Cleaner Infrastructure Development Choices” | Climate Change, November 2012

China and India, with their high economic growth trajectories, offer the planet a significant opportunity to reduce carbon emissions provided they invest in climate-smart infrastructure. The globe is also becoming increasingly water stressed. Understanding the energy-water-climate nexus is critical to achieving sustainable development. View chapter

ACADEMIC PAPER: “Sustainable Growth for China: When Capital Markets and Greener Infrastructure Combine” | The Chinese Economy, Sept/Oct 2011

The world’s economic system and ecosystem have everything to gain by teasing apart the infrastructure and climate change-related issues for China. View a summary

Op Ed: Australian Floods Impact on Asian Trade | Lloyd's List, Jan 2011

Backwash from the floods which ravaged Australia in late December and early January is now rippling through the global coal trade like a tsunami. Download pdf

Op Ed: “China ramps up gas investments” | Lloyd's List, Nov 26, 2010

As China continues to evolve its economy, natural gas becomes an increasingly attractive source of cleaner energy and for diversification purposes. Download article

Op Ed: “Global gas, an ever-changing plot” | Lloyd's List, Sept 24, 2010

Shifts across the globe in natural gas consumption and production tell a new tale. What happened in Texas, didn't stay in Texas. Download article

Op Ed: China's coal consumption in its energy mix and green prospects | Lloyd's List, 2010

FEATURE ARTICLE: “The Barnett Shale,” unconventional natural gas story

The Barnett Shale, natural gas story was a feature in one of three issues submitted that helped D CEO magazine win a major national . Natural gas is gaining traction as an energy source with potential beyond its traditional uses. New shale plays like the Barnett Shale and the Marcellus Shale are adding to supply at a time when high energy costs and greenhouse-gas emissions concern households, businesses, and politicians alike. What might the future hold for natural gas, with its ability to morph into numerous energy forms, in solving some of America's energy challenges? (published in D CEO magazine, September 2008)

Editor Glenn Hunter wrote: "I want to personally thank you for your contribution to D CEO. No doubt about it: You're a big part of why we're in the running for this prestigious award, and I appreciate it."

FEATURE ARTICLE: “China's Green Future”| Far Eastern Economic Review, December 2008

With Obama's pledge about America's clean energy future, this strategic direction can help the U.S. out of its economic malaise and restore leadership on the issue of carbon-dioxide emissions reductions. Understanding China's huge energy-related challenges illuminates the out-sized opportunity for America. Beijing's energy goals can be fast-tracked with the help of American companies, and both countries will benefit from enhanced green trade routes. Download article

FEATURE ARTICLE: “Paving the Path for India's Growth” | Far Eastern Economic Review, March 2008, with co-author Dr. Andrew Chen, distinguished professor of finance

For India's rapid growth to continue, investment in infrastructure would need to double, from 5% of GDP to an estimated 9% by 2012 -- or $500 billion. Utilizing global capital markets and the private sector is the way forward for greater efficiency, transparency, and proper incentives. Incumbent approaches in financing infrastructure have shortcomings that encourage waste, inefficiency, and corruption. India is perfectly poised to leverage a new market-based approach for sustainable infrastructure development to the benefit of its economy, the Indian public, and global investors. Download article

FEATURE ARTICLE: “The Chinese Connection” | D CEO, January 2008

Profile of CEO Patrick Jenevein of Tang Energy, a U.S.-based energy firm focusing on wind energy development and green tech processes in power generation, with rich experience in China. Illustrates a firm uniquely addressing the pollution problem in China, one consequence of rapid economic growth and high demand for energy. Download article

WHITE PAPER: Retirement Security in the 21st Century: Considerations and Risks in Building the Infrastructure

A white paper developed to educate financial services professionals about trends.

ACADEMIC PAPER: “Complementing Economic Advances in India: A New Approach in Financing Infrastructure Projects,” Journal of Structured Finance, Summer 2007

The use of global capital markets holds promise for India's continued economic development. View a summary.

COVER STORY: D CEO, July/August 2008

Fluor's CEO Alan Boeckmann and their evolution as a global firm. View the article. An excerpt:

Fluor received its first contract abroad in the Persian Gulf in 1933 between the two World Wars, erecting cooling towers for a refinery under construction. Expansion in the Middle East, Canada, and Latin America gained speed, following much of the design and building occurring in the petrochemical industry.

Boeckmann recalls his early days at Fluor and how the curve was trending in regards to today's "globalized" world. "Globalization has no doubt changed the dynamics in our business," Boeckmann says. "When I came to Fluor in 1974, it was a time of rapid growth. Then our competition was almost entirely from U.S. firms. Today, we have gone through several waves of new entrants. It started with Asian entrants--Japanese, followed by the Koreans--and then the Europeans. We now see Chinese firms coming to the market albeit utilizing their resource advantage, well-trained but cheap labor." While today they are competing in the Middle East for construction-only projects, within five years, Boeckmann expects the Chinese will be competing against them for total project responsibility.

The latest thinking on globalization suggests that developed countries such as the U.S. need to stay ahead of the competition with their value added, namely staying on the forefront of scientific and technological advances. Fluor is no stranger to technological advances and the need to stay ahead with innovation. In 1921, they introduced the "Buddha" cooling tower, named after its resemblance to a Buddhist shrine, its first product manufactured and a radical advance in the cooling of water. Another advance in the 1950s, introducing the use of scale models of plants as design tools, ultimately led to Fluor becoming an expert in lifting and rigging huge vessels. Today, Fluor's focus on green technologies and solutions is building steam (and is re-capturing it literally for re-use).