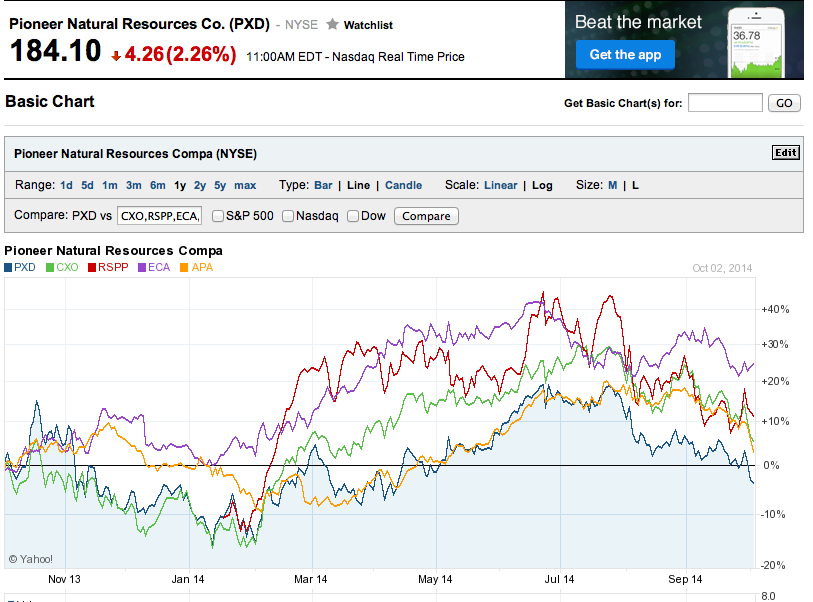

Given the breakneck-pace of shale oil production in the Bakken, Eagle Ford and Permian Basin, many stocks of the larger exploration and production firms drilling in these basins have been hammered as West Texas Intermediate (WTI) has tumbled.

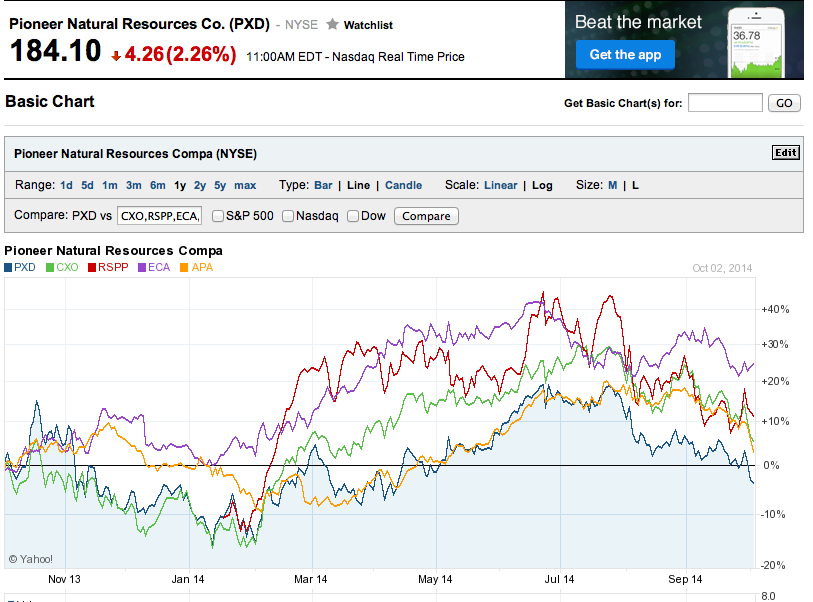

Pioneer Natural Resources, a leader and top producer in the Permian and Eagle Ford, has seen its stock rise to $234.00 and fall back to $184.00, from virtually the same position as last year. $13.3 billion market cap Concho Resources (NYSE:CXO) followed the same trend as Pioneer. The smaller, newer additions such as RSP Permian (RSPP) recognized smaller price losses but it began from a lower price realization as a new IPO in January of 2014. When interviewing the CEO of RSP Permian in July, the sentiment about the Permian Basin's sustainability was positive.

According to Gray, he expects the Permian to continue producing when other basins slow down. Given its 'massive reserves, right geology, and history of oil and gas infrastructure,' these attributes combine for ease of operations and competitive advantages. The midstream segment of the oil and gas industry, charged with transporting, processing and storing resources, has been tracking the developments in production with some time lags. A recently published interview with CEO Kelcy Warren of Energy Transfer, a publicly-traded family of MLPs, or master limited partnerships, reveals one firm's continued growth and transformation as the industry continues to increase production. The midstream sector has made considerable investments in infrastructure to move the U.S. supplies around the country, and for export. (My report details some of the growth areas emerging from the midstream sector.)

Concerns about the oil supply growth with the potential for glut have been on the radar of numerous analysts for over one year. The prices of Brent crude and West Texas Intermediate (WTI) have fallen in tandem in the last few months. "WTI fell below $90 a barrel today for the first time in 17 months, extending this year’s decline to 9.9 percent," notes Bloomberg, and "Brent crude, fell 20 percent from its June peak to trade at $92.24 a barrel today on London’s ICE Futures Europe exchange." Weaker global demand and ample supply is a main culprit of the Brent crude decline; conversely the WTI declines are partially based on supply factors resulting from U.S. oil supply growth, along with the influences of Brent factors.